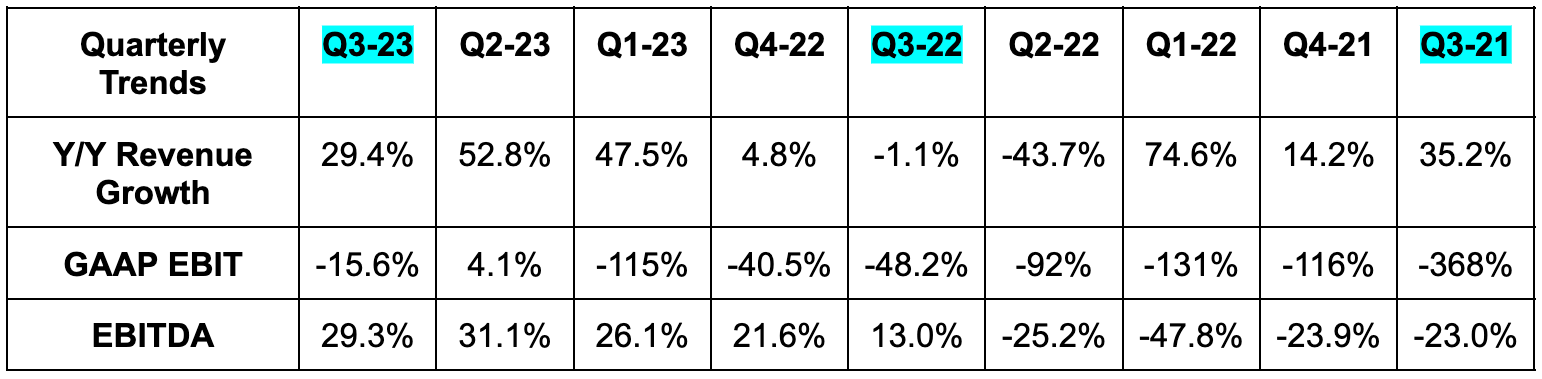

Hims & Hers Health Inc. (HIMS)

Results

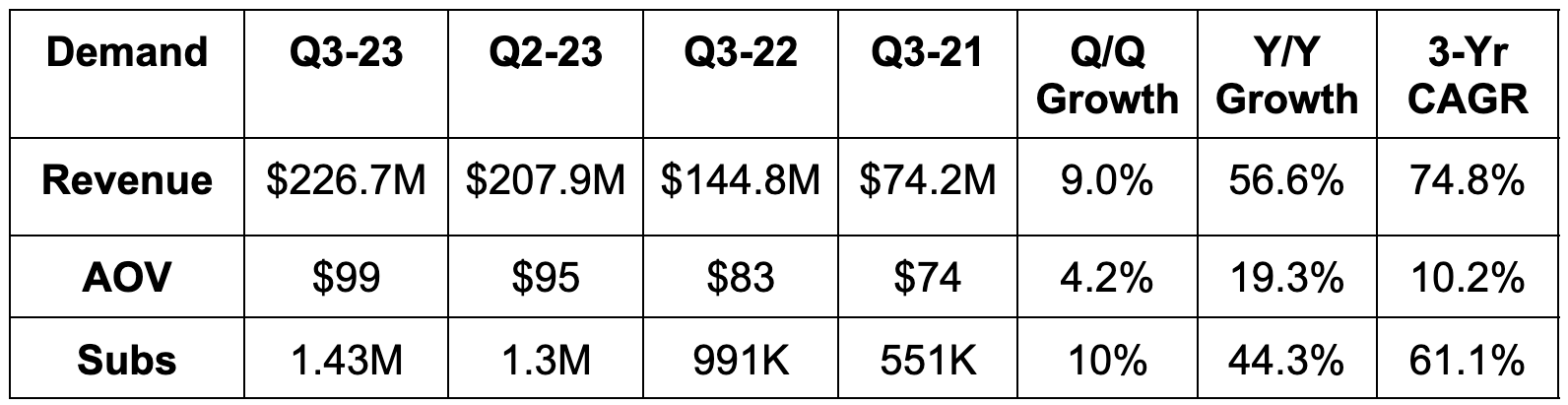

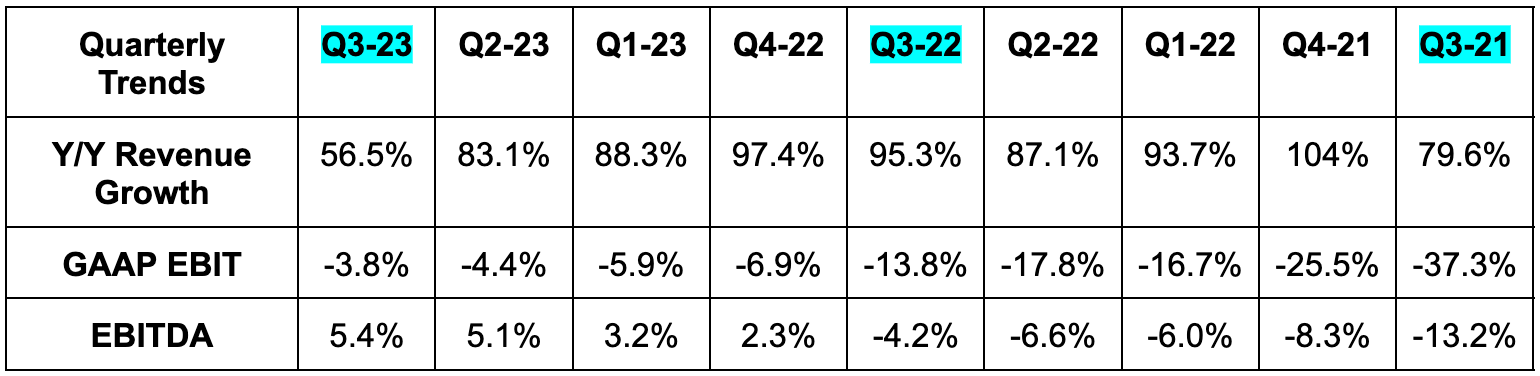

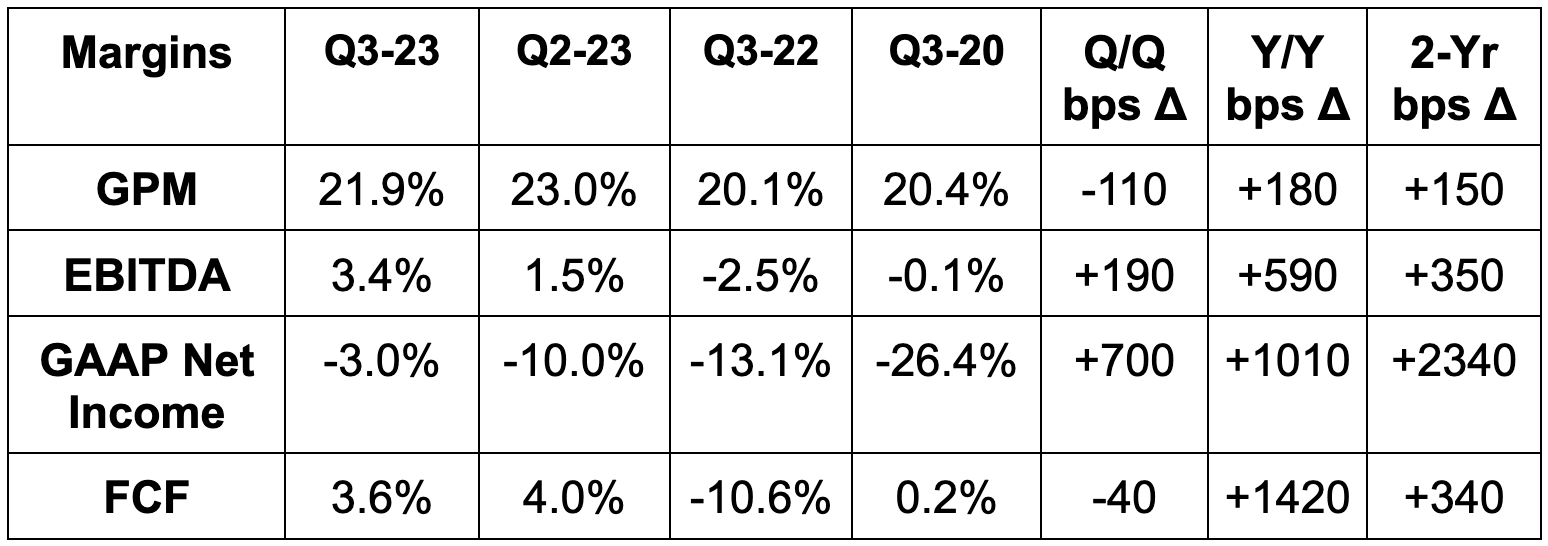

- Beat revenue estimates by 2.9% & beat revenue guidance by 3.3%. Its 74.8% 3-year revenue CAGR compares to 80% Q/Q & 91% 2 quarters ago.

- 90%+ of this revenue is recurring.

- Beat EBITDA estimates by 3.8% & beat EBITDA guidance by 6.5%.

- Missed GAAP EBIT estimates by 12%; Beat GAAP GPM estimates.

- Missed -$0.03 GAAP EPS estimates by a penny.

AOV = Average Order Value; Subs = Subscribers

Q4 Guidance

- Beat revenue estimates by 7.9%.

- Beat EBITDA estimates by 45%.

Balance Sheet

- $210 million in cash & equivalents.

- Inventory flat year-to-date.

- New $50 million buyback. Share count rose by 2.4% Y/Y.

30,000 Ft. View

This company relies heavily on external marketing for growth. That led many to believe it couldn’t possibly keep scaling without diminishing returns. Well? This quarter, it has continued to rapidly scale with significant operating leverage and a gross profit payback period of under 1 year. The marketing machine continues to effectively hum.

It also continues to find success with prescription personalization and is wrapping up “migration to affiliated facilities” to enhance its ability to provide granular care. The runway also remains long. Within its 4 core categories (men’s/women’s health, dermatology & mental health), it only offers 11 of its potentially planned 20 products. It also expects to eventually be in weight loss, pain management, fertility and diabetes. It has proven that it can successfully launch products and build meaningful traction through marketing. These launches should be no different.

If customer acquisition cost continues to be well controlled, this should continue to work. If not, it likely won’t. I candidly do not have a good sense of direct-to-consumer prescription market dynamics, so will leave it to you to decide.

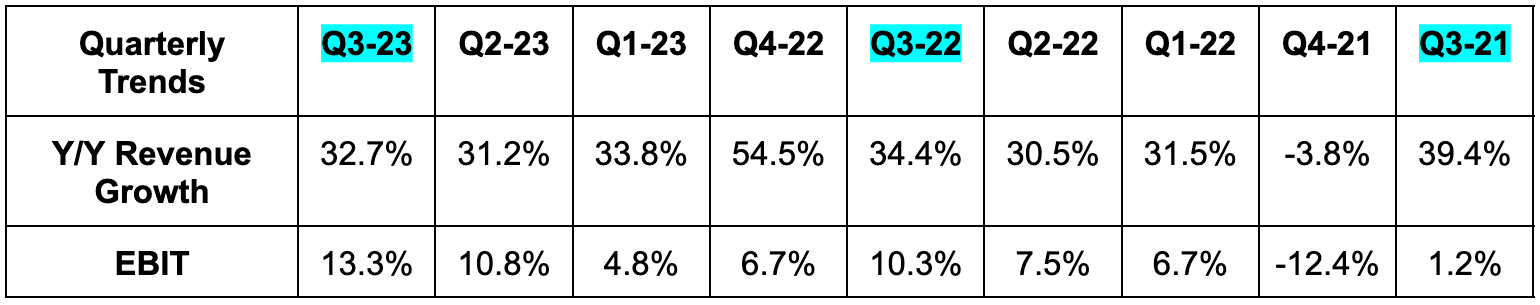

Axon (AXON)

Results

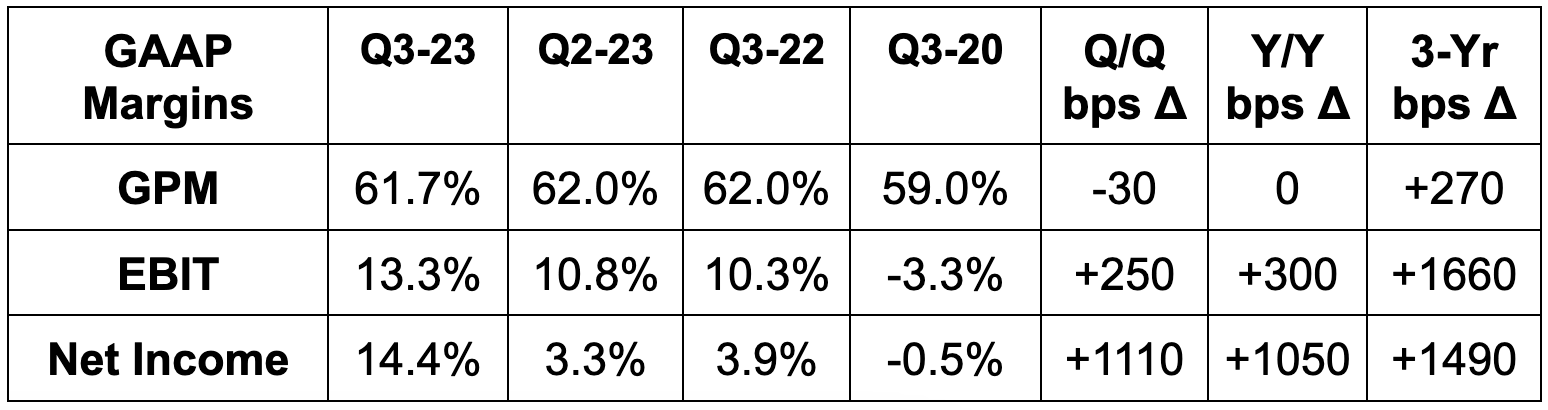

- Beat revenue estimates by 5.7%.

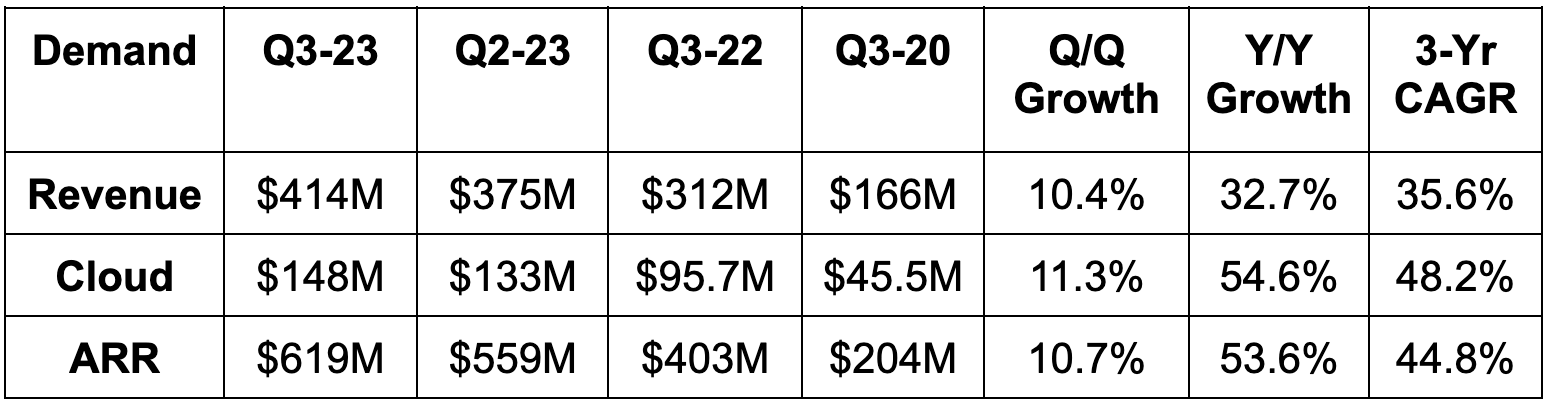

- Its 35.6% 3-yr revenue CAGR compares to 38.5% Q/Q & 32.6% 2 quarters ago.

- 122% net revenue retention vs. 122% Q/Q & 120% Y/Y.

- Beat EBITDA estimates by 20%.

- Beat gross profit margin (GPM) estimates by 120 bps.

- Beat $0.38 GAAP EPS estimates by $0.40.

ARR = Annual Recurring Revenue

2023 Guidance Updates

- Raised revenue guide by 2.0% which beat estimates by 1.3%.

- Raised EBITDA guide by 5.9% which beat estimates by 4.7%.

Balance Sheet

- $480 million in cash & equivalents.

- Basic share count roughly flat Y/Y.

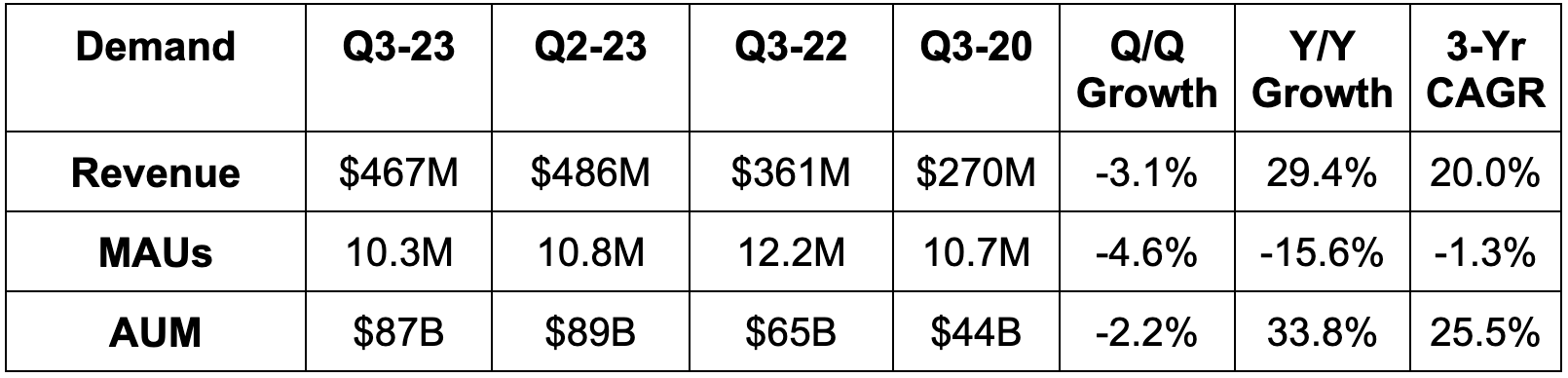

Robinhood (HOOD)

Results

- Missed revenue estimates by 2.3%.

- $80 average revenue per user vs. $84 Q/Q & $77 2 quarters ago.

- Trailing 12-month deposits of $17.3 billion vs. $16.1 billion Q/Q & $17.1 billion 2 quarters ago.

- Beat EBITDA estimates by 7.9%.

- Met -$0.09 GAAP EPS estimate.

MAU = Monthly Active User; AUM = Assets Under Management

2023 Guidance Updates

The firm raised its GAAP operating expense guide for 2023. This was related to a $104 million regulatory accrual during the quarter. Regulatory accruals are adjustments to account for future expected regulatory liabilities.

Balance Sheet

- ~$5 billion in cash & equivalents.

- Shares up 1.5% Y/Y.

Upstart (UPST)

This quarter did not do anything to make me entertain owning this name again. If anything, it did the opposite. Clearly, macro is heavily weighing on its violently cyclical model. I think poor leadership is amplifying the pain. Just look at Pagaya’s outperformance for evidence.

Results

- Missed revenue estimates by 3.7% & missed guide by 3.9%.

- Missed fee revenue guide by 2.1%.

- Missed -$0.02 EPS estimates & missed same guide by $0.03.

- Missed EBITDA estimates by 54% & missed guide 47%.

Next Quarter Guidance

- Missed revenue estimates by 14.4%.

- Missed $10.5 million EBITDA estimates by $10.5 million.

- Missed $0.06 EPS estimates by $0.22.

Balance Sheet

- $516 million in cash and equivalents.

- Loan balance roughly flat at $1 billion year-to-date as expected.

- Share count rose by 3.3% Y/Y.

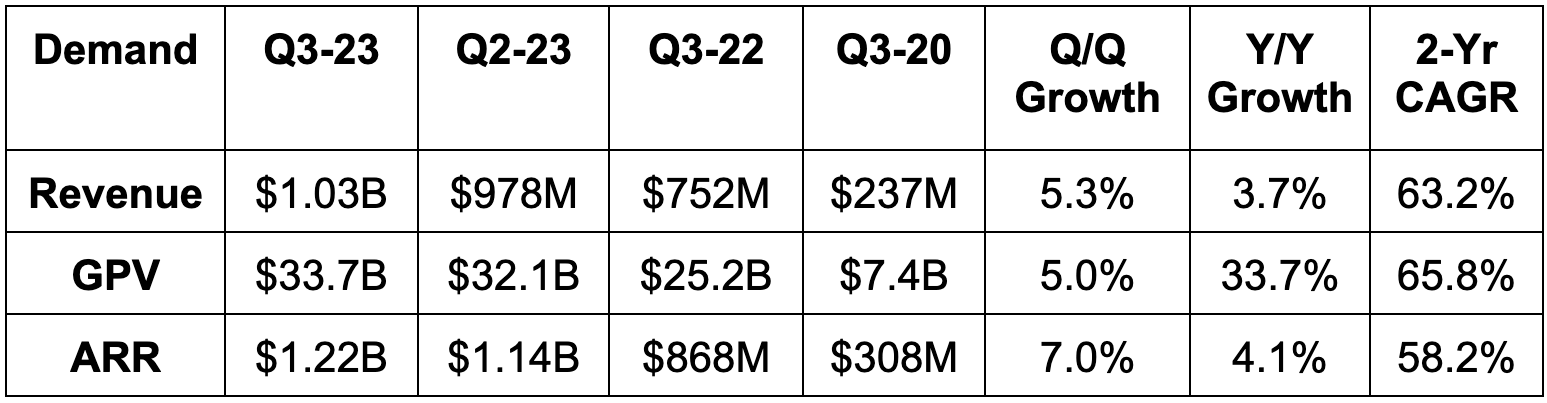

Toast (TOST)

Results

- Roughly met revenue estimates & beat guidance by 1.0%.

- 63.2% 3-year revenue CAGR compares to 51.5% Q/Q and 70% 2 quarters ago.

- Locations up 6.5% Q/Q and 34% Y/Y.

- Beat EBITDA estimates by 75% & beat its same guidance by 75%.

- Beat free cash flow (FCF) estimates by 33%.

- Met -$0.10 GAAP EPS estimates.

GPV = Gross Payment Volume

Q4 Guidance

- Missed revenue estimates by 1.5%.

- Missed EBITDA estimates by 16%.

Balance Sheet

- $1.03 billion in cash & equivalents.

- No debt.

- Share count up 4.4% Y/Y.

SoFi (SOFI) – Noise

Just like any disruptor, when SoFi’s stock price falls, bears emerge with new risks to consider. When the stock rises, these same folks mysteriously vanish. What a coincidence. Most of the time, ~brand new~ risks are quite creative, to put it kindly. Sometimes they’re legitimate, but often not. There have been 3 items brought forth by SoFi bears this week that I wanted to address. I consider all three to be in the “creative” risk bucket. I’ll cover them here.

Fair Value Markings

The first “risk” from this week was SoFi’s 5.1% gain on sale margin from a personal loan sale being misleading. A few concerns were included in this item. First, SoFi only sold about $15 million in loans. Some think this means that it can’t sell more. Not so fast. SoFi’s Northstar is maximizing return on assets and equity (ROA & ROE). It simply makes more today by holding personal loans than it can with a sale. If it has the capital ratios to store more loans, which it does, why not do so and earn more money? That’s exactly what SoFi is doing.

These small sales are symbolic nods to the investor community that capital markets remain wide open to the firm. It will only sell loans if it becomes capital constrained (topic of the next risk) or if it can swap this credit out for higher margin assets. And furthermore, it has already secured $100 million in credit in Q4. It also locked in another $2.5 billion as part of a forward funding agreement and an asset-backed securitization deal with Blackrock. Again, capital markets remain wide open to this company as or if it feels the need to use them.

The second risk within this bucket regards where that 5.1% in transaction profits came from. All of that premium came from servicing rights rather than from the actual principal. Thankfully, I went to grad school to explicitly learn about items like this and was able to dust off a textbook to refresh my memory. Long story short, this is nothing burger. Why?

Servicing rights are not randomly and independently assigned to deal terms. They’re tightly correlated with the overall compensation actually received. Thinking this isn’t the case is like thinking rainy days don’t make umbrellas more common. Premium was shifted from principal and interest payments to servicing rights to lower the upfront payment from the capital market buyer to SoFi. As a reminder, SoFi continues servicing the loans after the sale is closed. This SoFI concession was highly intentional and savvy. It allowed it to secure MORE profit over the term of these loans via a higher servicing revenue share agreement with these buyers.

As long as SoFi remains confident in the health of its credit book, this is a no-brainer. And that book continues to vastly outperform loss ratio benchmarks as its credit standards remain highly stringent. Its borrower’s FICO is well over 750 and their annual income is well over $150,000. This accounting is not only entirely normal, but it meshes perfectly with its aforementioned priority of maximum ROE. Why not assume more present value at the time of a sale?

One final note on this which is a bit of a review for consistent readers. Skeptics of SoFi claim its fair value accounting is shady. They think Current Expected Credit Loss (CECL) accounting is better. Couldn’t disagree more. CECL isn’t better, it’s more commonly used and is, in my view, worse. It requires less frequent credit markings and so a higher risk of pent-up unrealized losses building on the balance sheet. Instead, SoFi recognizes these losses quarterly. Furthermore, it uses an independent 3rd party to mark its credit. The assumptions embedded in the markings assume 5% unemployment, -2.5% GDP growth and loss rates materially higher than what SoFi has actually realized. The markings are intentionally and wildly pessimistic. That is another reason why it continues to sell credit blocks well over these markings; they represent a worst-case scenario that has not come close to manifesting.

Loan Growth

The second risk cited is that SoFi will soon become capital constrained and loan growth will grind to a halt. I don’t see this happening for a few reasons.

SoFi’s capital ratios remain in excellent shape. Still, total risk-based capital ratio will likely be the first bottleneck. It sits at 14.5% today vs. a 10.5% minimum. This ratio simply divides its $3.34 billion in risk-based capital by quarterly average assets of $24.2 billion. At current risk-based capital levels, this only allows SoFi to grow its quarterly average assets by $7.5 billion. With $2.5 billion in locked up funding supply, we can call this cushion roughly $10 billion. That gives it just two more quarters of origination runway before it approaches the 10.5% minimum that it will try to stay well above. Ok, well this makes it sound like SoFi’s lending growth can’t continue for much longer. It makes bears sound right. But let’s take this thinking a level deeper.

There are two reasons why this isn’t the case. First is clear and easy access to capital market funding supply. As covered in risk #2, SoFi has demonstrated an ability to tap into capital markets at hefty premiums. It has seamlessly done this during one of the worst backdrops in recent history. We’ve already covered why those premiums are entirely legitimate. Credit spread dynamics will eventually improve for the industry and SoFi’s seemingly best in class access to capital markets will only strengthen further from here. If it has the ability to secure $2.5 billion in forward funding TODAY, do we really think it can’t access capital markets during more tranquil times? That’s counterintuitive.

Easy access to capital markets at a time when those markets shuttered for many underwriters is key. It means it can recycle lower margin credit for more appealing credit. It also means the firm can sell off high margin credit at favorable terms to reload the quiver with more origination capacity. That, in turn, means SoFi can continue to grow origination volume rather than simply holding it steady for the next 6 months and beyond.

Finally, net income feeds tier 1 capital. I think it will earn about $500 million in GAAP net income through the end of 2025. That added capital raises its quarterly average asset capacity to add more average assets from $10 billion to roughly $13 billion. Net income will allow it to rely less on capital market sales and to focus more exclusively on maximum ROE in the years ahead. It’ll still need capital markets, just not as intensely. This is why the current profit inflection expected next quarter is so vitally important.

This doesn’t even consider the fact that SoFi also has about $4 billion in available warehouse capacity. If there’s some credit shock and capital markets close for SoFi, this gives it another quarter of originations. Yes, the margin would be lower by about 150 basis points considering the higher cost of capital, but it would still be favorable. And SoFi could easily sell off those warehouse-funded loans when capital markets bounce back to replace the credit with higher return assets. I don’t see why capital markets would close to this company considering they haven’t closed through all of the macro and regional bank-specific turmoil. But even the worst-case scenario is easy to digest.

Finally, lending is NOT supposed to drive 2024 revenue growth. Financial services and its technology platform will. 67% of its growth came from those 2 buckets this quarter and that trend is expected to continue.

Insider Selling

Viral social posts have circulated claiming “this insider sold 30% or 50% of their shares.” That makes for a juicy headline, but more content is needed. The insiders cited directly own a small fraction of their overall SoFi interest in common equity. Most of it will be earned through its long term incentive plan (LTIP) as well as restricted stock units (RSUs) which vest over time. So? Sure they sold 50% of what they own today. For example, Chad Borton technically sold 49% of his share this week for $1.2 million. When actually digging into the proxy statement however, it explicitly states that he will earn $7.6 million in equity awards for the most recent year. So? He sold 11% of his shares when considering this award. He sold a much smaller percent of his shares when considering all of the equity he knows he has coming in years ahead. He makes $500,000 a year in base salary, which makes equity his main form of compensation. Can you really blame him for selling some? I don’t. We all have bills and we all boats. The same is true for the other two executives who sold this week.

Considering this, I find this insider selling to be noise and not signal as it usually is. This is especially true considering both Anthony Noto and CFO Chris LaPointe bought more shares this week. Small purchases, but still notable.

Amazon (AMZN) – Subscriptions, No Subscription Needed & More

Healthcare

Earlier in the year, Amazon purchased One Medical for $4 billion. The company provides virtual care services and a large network of primary care office relationships. As part of this deal, Amazon will launch a new Prime benefit for $9/month ($99/year). This subscription will offer 24/7 virtual care access at no added cost and “easy to schedule office visits” for same day care in select cities. In the One Medical app, users can easily communicate with doctors and manage medications. Members can also add additional people to their subscription for another $6/month each.

Amazon Prime is perhaps the most compelling subscription in the world. It laces together countless value-add services to motivate strong retention and customer lifetime value. The better retention at scale allows Amazon to offer access to promotions that others simply can’t afford. Some think AWS is the only thing that funds Amazon Prime, but North American EBIT margin trends tell a different story. The release simply fortifies this equation. It should increase overall Prime utility and motivate even lower churn.

Grocery

Amazon is opening up its Amazon Fresh grocery delivery to non-Prime members. This will start in U.S. Cities where its Amazon Fresh stores are available (not many) and also with grocer partners like Bristol Farms. Whole Foods will be added to this service in the near future.

Interestingly, this news coincided with an update to its brick-and-mortar Fresh Stores. Experiments conducted on store updates in Chicago are promising with a 90% customer satisfaction rate. That’s what happens when your stores have Krispy Kreme shops inside (kidding). This success will lead it to implement the new model in its 3 L.A. stores while opening more in 2024.

More

- Amazon conducted a round of layoffs within its music streaming business.

- Rumors are circulating that it will bid on Premier League broadcasting rights.

Meta Platforms (META) – China

Meta and Tencent have agreed to a new partnership. In China, Meta will exclusively sell a cheaper VR headset through Tencent starting next year. Meta’s apps are banned there, but this gives it a foot in the door to re-enter the market. It’s a very small foot considering how tiny this revenue segment is and will be in the near future.

Lemonade (LMND) – Various News

- Lemonade crossed 2 million customers this week as expected.

- It filed a new shelf offering giving it the ability to raise capital in the future. These raises will not be until the firm is profitable in 2025. We’ve been promised that many, many times by leadership. I fully expect them to keep their word.

Disney (DIS) — The Marvels

Headlines are swarming about The Marvels being one of “Disney’s worst box office openings ever. More context is needed:

- Actor strikes have thrown a wrench in title promotions. Disney had just a few days of promotion with its lead actors. That’s also partially why Sony’s title released this week is struggling early on.

- It was fully expected to be one of Disney’s worst openings ever.

- International results are faring better than they are domestically.

- Elemental had an awful opening weekend and proceeded to rebound thereafter.

- This is based on Thursday data, with the expectation of children flocking to theaters on Friday due to the holiday.

- Changes to content creation approach at Disney will take time to play out. Films include multi-year contracts which means changes made this year will unfold over the coming years.

Macro

Output data

- Atlanta Fed GDPNow forecast for Q4 is 2.1% as expected.

Inflation data

- This week’s 10-year note auction closed at a 4.519% yield vs. 4.610% last month.

- Michigan 1-year inflation expectations for November are 4.4% vs. 4.0% expected and 4.2% last month.

- Michigan 5-year inflation expectations for November are 3.2% vs. 3.0% expected and 3.0% last month.

Consumer & employment data

- 217,000 initial jobless claims vs. 215,000 expected and 220,000 last week.

- Michigan Consumer Expectations for November came in at a reading of 56.9 vs. 59.5 expected and 59.3 last month.

- Michigan Consumer Sentiment for November came in at a reading of 60.4 vs. 63.7 expected and 63.8 last month.