Gold prices are up this year. Why?

In one sense, it’s kind of a stupid question – or is it?

I got interviewed by Asian TV recently about this topic, and thought I’d stream some thoughts here, focusing on basic principles.

First, gold is a metal, an investment, and a religion (almost), all at the same time.

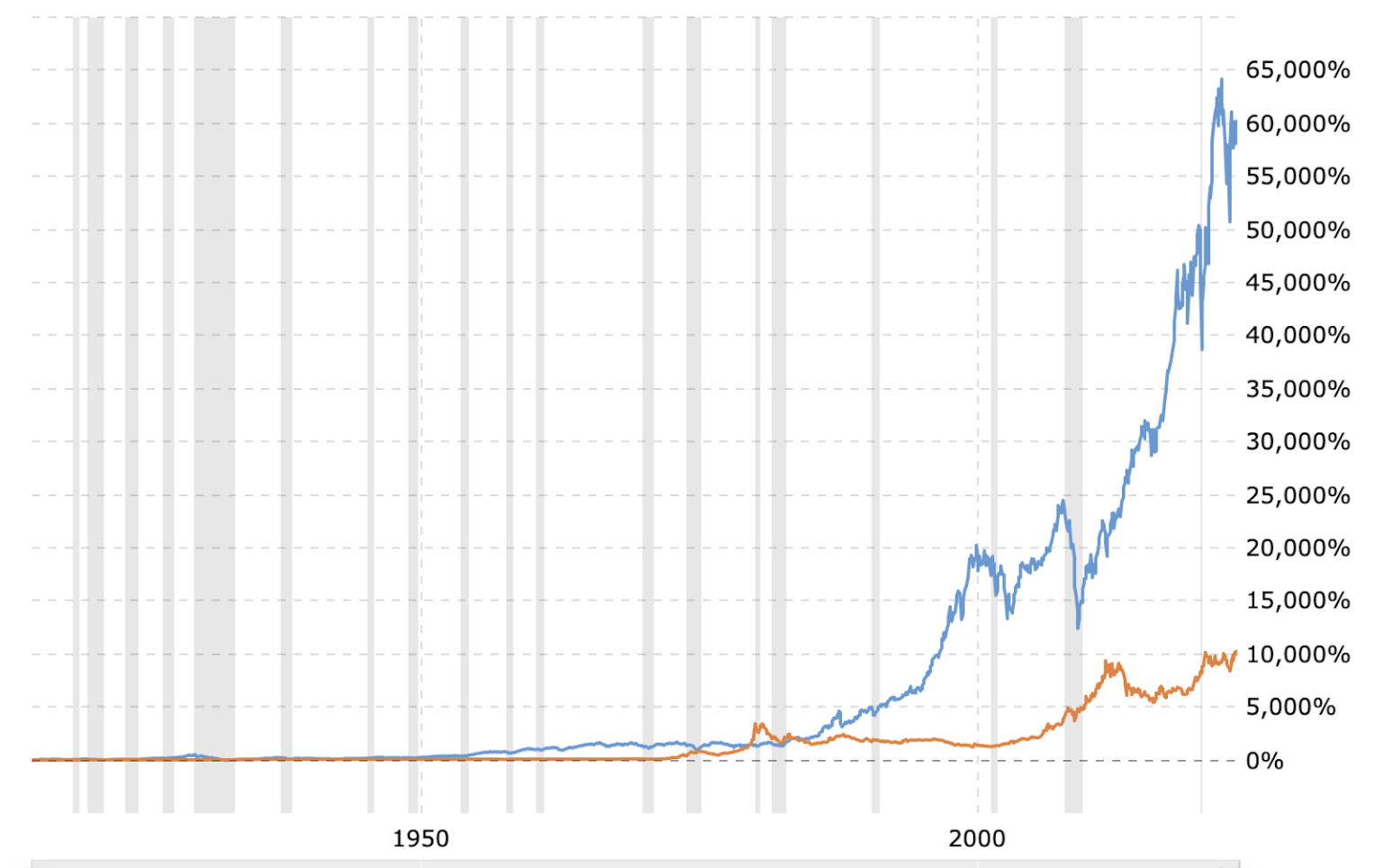

Over the long run, stocks have crushed gold, as this chart from Macrotrends.com shows (Dow Jones Industrial Average is in blue, and gold prices are reddish-orange).

Gold: A bad long-term investment

Gold bugs – the gold market’s version of perma-bulls or diamond hands – hate this fact, and point to the 1970s – a period of stagflation when both the US economy and stocks did poorly, yet gold did exceptionally well – as justification for expecting gold’s return to glory.

I’m not jumping into the fight and not saying they’re wrong that gold will perform well if things go to heck – that’s what gold is supposed to do – but without the 1970s data point, their case gets a lot weaker.

Personality-wise, gold bugs tend to skew right-wing, anti-government, and anti-central bank. They worry that fiat money leads to reckless spending, and point ou that in the second half of 1971, the US unpegged the dollar from the gold standard (i.e., gold convertibility), which made printing money easier, which made spending money easier for the government (Need more money? Just print more!), which increased the US’ debt and led to higher inflation.

Luckily, the US, through various actions like using its navy (and military overall) to de facto provide “global protection” as well as negotiating with the Saudis in 1945 to price oil in US dollars, established the dollar as the de facto world trade currency, and – economics being a social science –- as long as people believe the US dollar has value, it will.

The gold bugs believe – and history may prove them right – that fiat money in time equates to letting the inmates run the asylum, and that no fiat system has lasted for more than several hundred years or so. So it’s possible for gold to be a lousy investment for 100+ years and for gold bugs to look like idiots for several lifetimes, and then suddenly be proven very right.

But I digress.

Gold is a fear gauge in one sense: Gold can’t be debased or inflated away. So when things get really bad, the flight bypasses the US dollar and lands on gold.

But that’s not the case now.

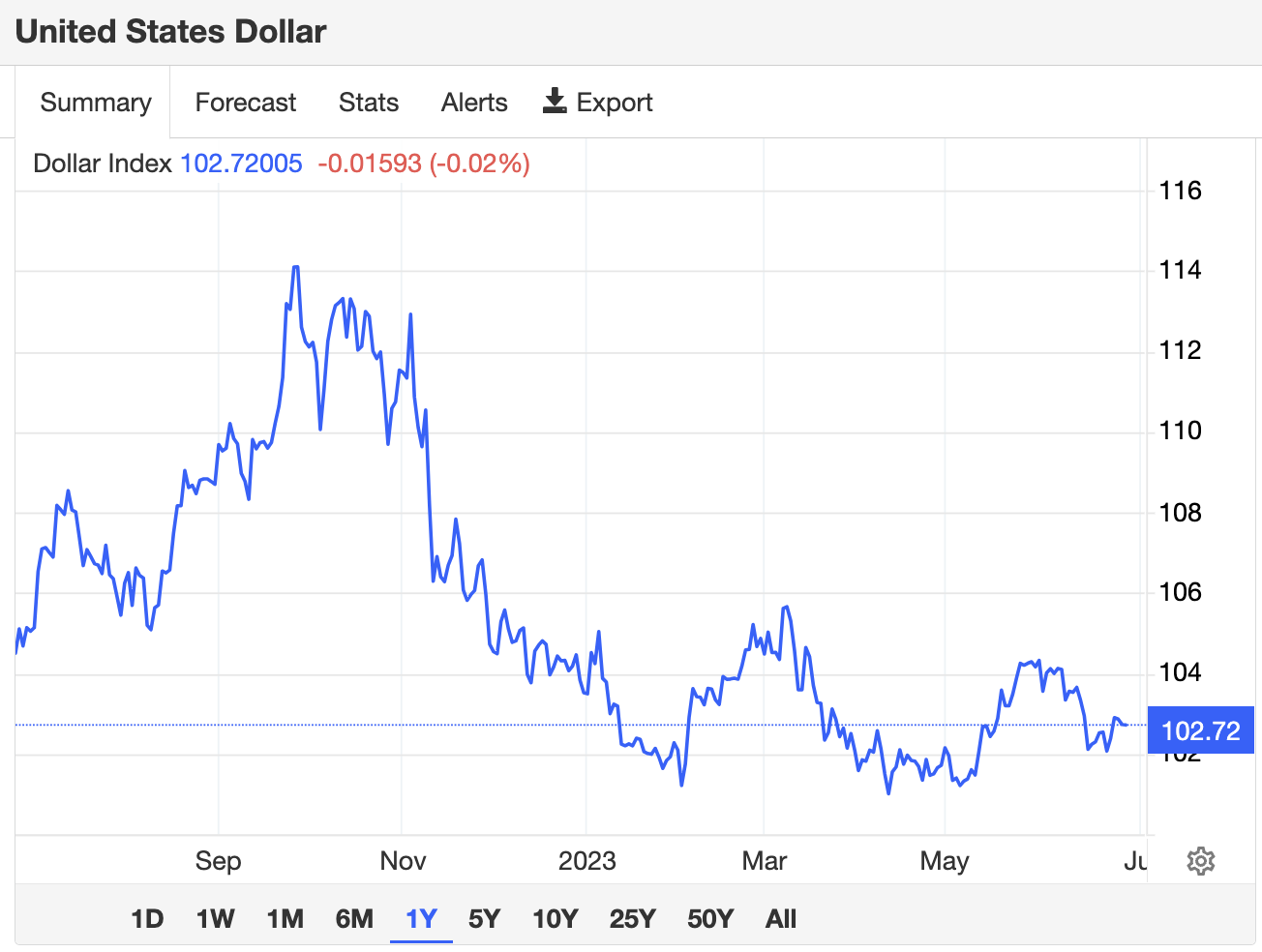

Gold is priced in US dollars (mostly) and the US dollar has gotten a lot cheaper recently. See this 1-year chart from TradingEconomics.com that shows the US dollar “index” – the US dollar versus six currencies: euro, pound, yen, Canadian dollar, Swiss franc, and Swedish krona. (Yes, the Swedish krona seems weird: The US dollar index started in 1973; if it were created today, I’m not sure the krona would be on there, given that Beyonce can move Sweden’s inflation numbers):

You get the idea: Gold’s “rise” is partly because of the US dollar’s decline (I know that gold has dipped a bit in the past few weeks; it’s up for the year, though).

There is some fear factor: Gold ETFs saw inflows after Silicon Valley Bank blew up.

But mostly, the true driver is inflation expectations. Higher US interest rates drive up demand for the US dollar (and signal a US economy so strong that it needs to be slowed down); they drive up demand because if US government bonds pay more, or are expected to pay more soon, foreign investors will want US bonds more, and therefore foreign investors will convert more foreign currency into US dollars (“buying” dollars) to buy the bonds.

This makes things priced in US dollars more expensive for people buying with other currencies, and gold is one of those things.

Conversely, if US interest rates drop – or if investors expect US interest rates to drop – the US dollar will weaken, and gold will become cheaper for people using other currencies to buy.

BRICs buying gold to oust the US dollar

Another other issue is that the central banks of Brazil, Russia, India, and China have been buying gold lately, as this whole business of US dollar trade hegemony is getting to them.

It’s not clear how much they can move the needle: 90% of foreign exchange trade involves the US dollar, and 60% of global foreign exchange reserves are in US dollars, so the BRICs are more likely to chip away at dollar dominance than unseat the dollar, but whatever they do, they’re pushing up gold demand on the way there.

These countries know they’re far from having the economic credibility of the US, so they see the instant credibility of gold as a potential shortcut. (NB: Gold itself is credible, but perhaps that credibility gets discounted when the gold is controlled by a lower-credibility regime?)

Should you buy gold today?

If you have an ideological reason for buying gold, you’ve already done so, and you’re not here for advice on gold in the first place (and for that matter, I don’t give advice in this blog).

I don’t think it’s a crime to have a tiny allocation to gold in case things really go haywire. In fact, I do.

(Separately, then there’s the question: Do you go the hardball route and buy physical gold from a gold dealer and store it? Do you buy gold futures? Do you buy a gold bullion ETF like the SPDR Gold Shares (NYSE: GLD)? Do you buy gold miner stocks, or an ETF of gold miner stocks? We can cover the “how exactly to invest in gold?” question later if there’s interest.)

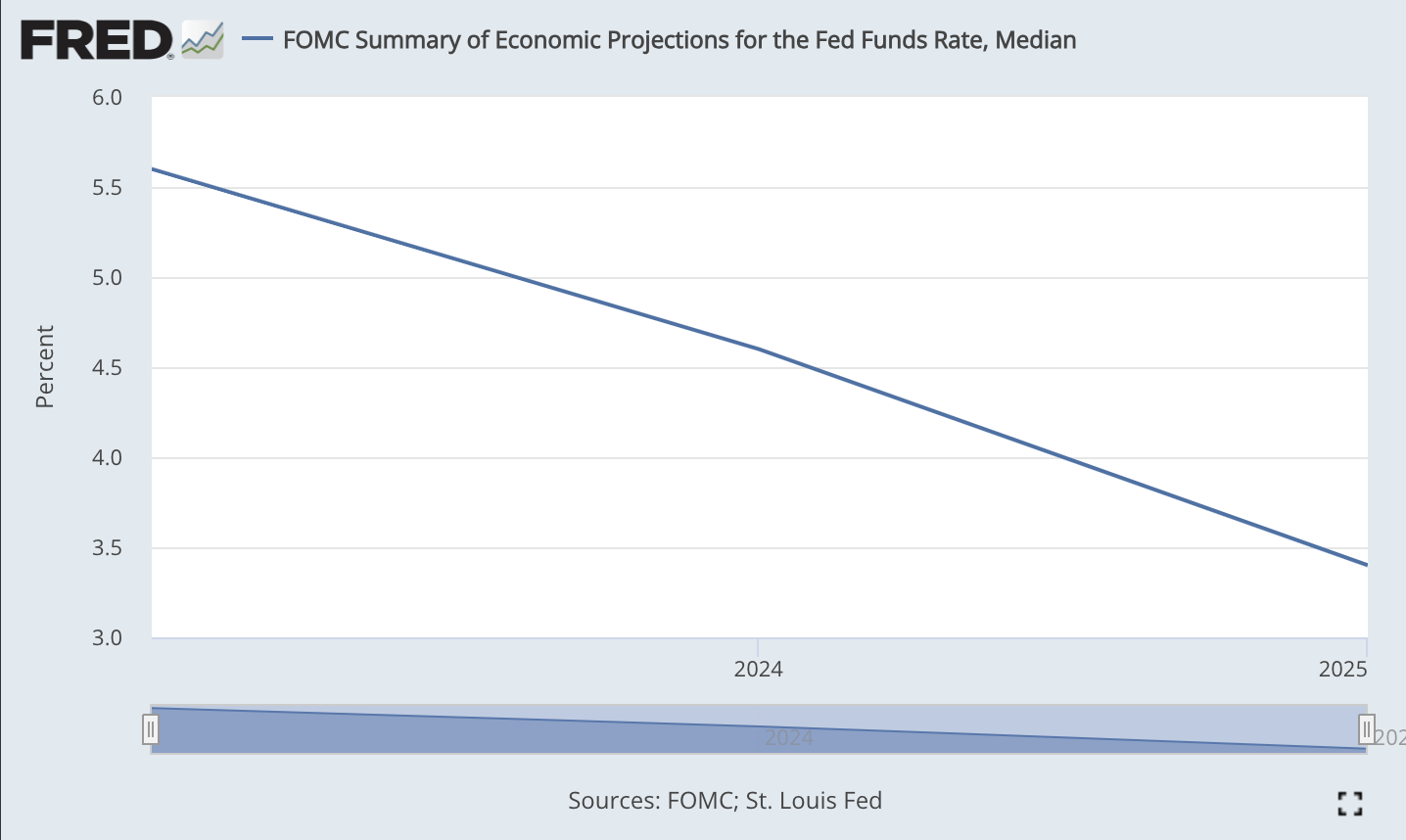

As I type this, US inflation appears to be getting under control. The US appears to be avoiding a recession, or at least a bad one. US interest rates might go higher, but they’ll probably go lower: In the most boring-looking graph in the history of graphs, the Federal Open Markets Committee officially expects interest rates to decline (and yes, they may be talking them down in hopes expectations become economic reality):

If US rates indeed go down, expect gold to go up.

But overall, I’m not speculating on gold now – or ever, really. Like fine art or crypto, it can’t really be valued, except to say: This is what people will pay for it. I’m leery of investments with religious overtones (read: so many people transacting for noneconomic/quasi-economic/passion-based/ideological reasons). I’d almost consider gold more insurance than investment.

So I’m holding, but not increasing or reducing, my small gold position.

James