Would you like to know the secret of retiring with $160,000,000 – from a middle-class salary?

Someone’s done it.

Technically, it was $70,000,000, but that was in 1991. The comparable amount in today’s inflation-adjusted money would be $160,000,000.

This investor’s name is Ted Johnson. You can Google him. Ted retired from UPS in 1952. He never made more than $14,000 per year – which was a middle-class wage back then.

Ted’s success comes down to two, or two-and-a-half, factors:

- Ted invested regularly. One thing Ted did that many people didn’t do back then – and probably still don’t do now – was consistently invest money every month. Regular investing can be an easy-to-understand-but-hard-to-actually-do thing.

- Ted delayed gratification, likely substantially. Regular investing is hard because it requires sacrificing. Ted surely said no to a lot of here-and-now “rewards” – fancy clothing, nice travel, the latest cars – in favor of a more abstract, yet exponentially larger, reward later.

- Ted picked a decent-but-not-amazing investment. And I’m not even sure we could say that Ted invested responsibly, because Ted went as all-in as he could on UPS stock, an undiversified move that few, if any, financial advisers would endorse.

It’s waiting that helps you as an investor, and a lot of people just can’t stand to wait. If you didn’t get the deferred-gratification gene, you’ve got to work very hard to overcome that. -Charlie Munger

You might think I’m sandbagging on point #2. You might think that Ted got super lucky, and that UPS was mid-century America’s version of an Amazon or Apple or Microsoft – a moon rocket whose performance was exponentially better than the market’s.

You might think, in other words, that Ted’s results are a product of luck, and not repeatable factors.

UPS stock did well, rising about 11.9% per year.

But the S&P 500 was up 11.5% annually during the same period!

The fact that Ted’s portfolio only slightly outpaced the S&P is wonderful news for investors.

Ted didn’t grow his investments to $70 million because of a one-in-a-lifetime bet. Rather, the main driver was getting started early, being consistent, and investing as much as he could.

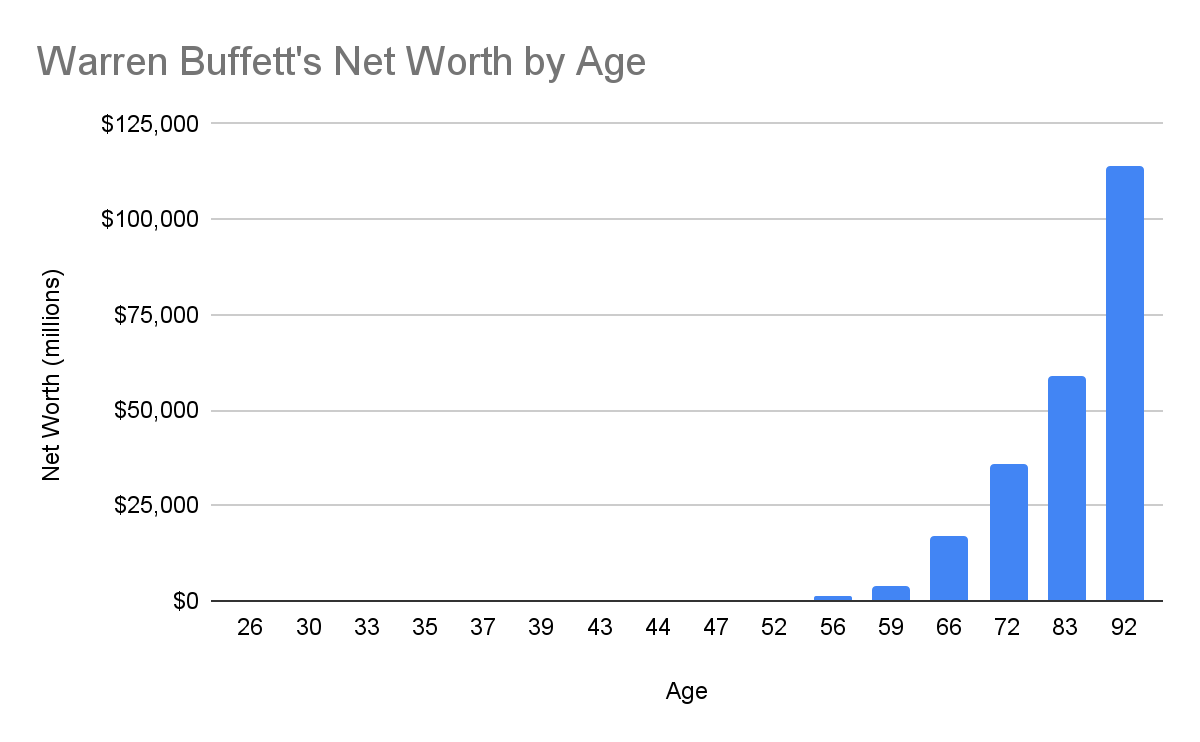

Warren Buffett, one of the world’s richest people and formerly the world’s richest, compounded wealth at 20% per annum. That’s higher than 11.9% and 11.5%, but it’s not ridiculously high.

Rather, like Ted, the larger driver of Buffett’s ridiculous wealth was how long he’s been in the market. As Morgan Housel often says, on a percentage basis, nearly all of Buffett’s net worth came after his 65th birthday (and really, even his 50th).

Speaking of ridiculous, Buffett’s $1.4 billion net worth at age 56 is just 1.2% of his current net worth, but it barely registers on the chart. (And Buffett has given nearly $40 billion to charity, too.)

Maybe you’re not starting to compound your wealth at as young an age as Warren Buffett or Ted Johnson. Maybe you’ve got kids or a spouse with special needs, or just a big alimony payment, or other expenses that preclude you from saving quite as much as Ted did. Maybe you won’t get 20% annual returns, or 11.9% or even 11.5%.

Fine. You don’t need to become a billionaire. You don’t even need $70,000,000. The forces of compounding are so strong that if you start now and stay consistent, there’s a decent chance – based on market history – that you’ll end up with more than you think decades down the line.

In my experience, most people underestimate the power of compounding.

BBAE wants you to be as successful as Ted Johnson. Or, at least to have a comfortable retirement, free of money worries.

We’ll even give you up to $400 in bonus money after you make your first deposit.

Beyond that, we’ve got spades of resources – research., data, curated stock lists, smart beta portfolios, and more – aimed at helping you get the best returns possible.

But the most important thing is to simply get started. To do so – and take advantage of our special bonus money – simply click this link right here.

BBAE’s Big Benefits to You

And keep in mind: these are in addition to all the benefits you get with a BBAE account in the first place. Those benefits include:

- Free equity trades

- “Copy trade” functionality in BBAE’s Town Square

- Curated stock ideas and themes in BBAE’s Discover section – some follow top investors, whereas others follow themes like EVs, semiconductors, SaaS, and more

- Up to level 4 options trading – plus BBAE’s theoretical options pricing tool

- Real-time market data, financials, and charting

- Industry-leading content and education

- $500,000 of SIPC insurance

- Three exclusive smart beta portfolios from industry leader MarketGrader (in BBAE’s MyAdvisor)

- A bonus of up to $400 in BBAE Dollars for opening and funding your account