3 Big Questions for Berkshire Hathaway

Friday, May 4th, Saturday, May 5th, and Sunday, May 6th, something magical happens for investors: Berkshire Hathaway holds its annual shareholders’ meeting.

As a shareholder and semi-long time attendee (I attended every meeting since 2018, and I wish I’d started earlier), I’d like to share what I’m expecting.

(If you’re looking for a primer on Buffett and Berkshire and why they matter, check out my prior blog post here.)

First, and sadly, this will be the first meeting held since Buffett’s longtime partner Charlie Munger passed away. Buffett called Charlie the “architect” of Berkshire in his annual letter. Charlie was not only brilliant, but was the comedic life of the meeting, typically giving a one-line zinger following a more serious, drawn-out answer to an audience question by Warren. (The meeting begins with a funny video, then a report from Buffett and, sometimes, lieutenants on Berkshire’s condition. Then Buffett and, until this year, Munger, would take hours upon hours of audience questions while munching See’s peanut brittle and drinking Coke.)

Background on Berkshire Hathaway and Warren Buffett

A second preliminary point I’ll make is that (as a biased Buffett devotee) I believe most non-devotees view Buffett and Berkshire’s accomplishments through too narrow a lens: returns.

Berkshire’s 3,800,000% returns are the most eye-catching aspect of things Buffett.

But I’d argue that Buffett has, through successful example, proved out a whole style of investing, making two major contributions to investing society in the process:

- Buffett has created adherents in legions of copycat investors, to the point that it’s a lot harder for Buffett himself to make money

- The presence of Buffett’s capital and Buffett-inspired capital in markets has caused many companies to be more Buffett-y, via shareholder friendliness, clear messaging, and simple reporting.

Buffett has made aspects of investing “obvious” to today’s investing community that weren’t obvious before. That’s a bigger contribution to the world than both Berkshire’s investment returns and Buffett’s pledge to give 99% of his $130 billion-or-so fortune to charity.

An Anti-Buffett Counterpoint

Charlie Muger liked to quote German mathematician Carl Jacobi: “Invert, always invert.”

The most compelling case against adulation of Berkshire and Buffett may come from investor Larry Swedroe, who claims that Buffett was an average stock picker who just discovered a good set of factors 50 or 60 years before everyone else. Now, Swedroe claims, Buffett’s secret sauce has been discovered and “used up” by the market, and that, in academic parlance, Buffett was a better factor picker than stock picker. In other words, computer-created indexes that hold Buffett-y type companies deliver returns comparable to Berkshire.

To invert this inversion, I’m not really sure that this is a ding on Buffett. From one perspective, finding good factors is more systematic, and therefore more useful, than finding idiosyncratically good companies. But It’s certainly true that today’s Berkshire Hathaway won’t earn returns anything like what Buffett got 50 or 60 years ago.

Anyway, with the 2024 meeting at hand, here are my top three questions:

- How will Berkshire’s lieutenants – Greg Abel (CEO of Berkshire’s energy unit and vice-chairman of non-insurance operations), Ajit Jain (insurance head), Todd Combs and Ted Weschler (effectively co-CIOs in the making) – handle more spotlight?

It’s harsh but true: On the stage at Berkshire, Buffett’s lieutenants, juxtaposed against Buffett and Munger, have tended to come across like no-personality suits. That’s less a criticism of them as it is praise for Buffett and Munger. They’re irreplaceable.

Well, they’re irreplaceable as icons. But in a company structure sense, Berkshire has no choice but to replace them.

Greg and Ajit have received some stage time over the past few years, and each comes across as kindhearted and capable, if a bit dry. Todd Combs and Ted Weschler have been more in the shadows, but after hearing a rare podcast interview with Todd, I’ve got to say that I’m very impressed. He’s an INTJ like me, but a lot more savvy about investing.

I’m eager to hear more from Todd and Ted. And it’s possible that, as Charlie ostensibly did, Berkshire’s lieutenants have been downplaying themselves in the public eye at least slightly, not wanting to steal the spotlight from Buffett and Munger.

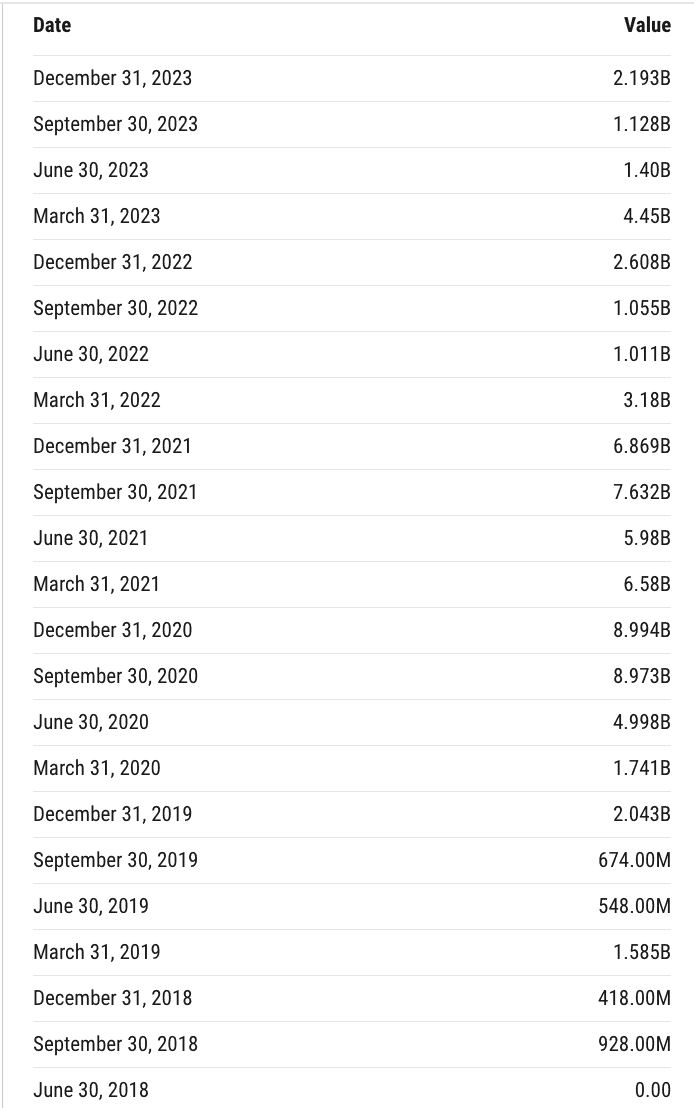

- What will Berkshire’s share repurchases be for 2024?

This is code-speak for: How cheap does Buffett think Berkshire Hathway’s sock is now?

After decades of no buybacks, Buffett turned on the spigot in 2018. The first few years were lean, but since then, he’s been systematic about buying when he feels Berkshire’s shares are cheap and holding off when he feels shares are pricey. (And we have to look at Buffett’s actions, rather than his words, because he nearly always says something sandbagging to the effect of Berkshire being richly valued and having few growth opportunities.)

Here’s a chart from Ycharts.com showing Berkshire’s buyback activity:

Source: YCharts.com

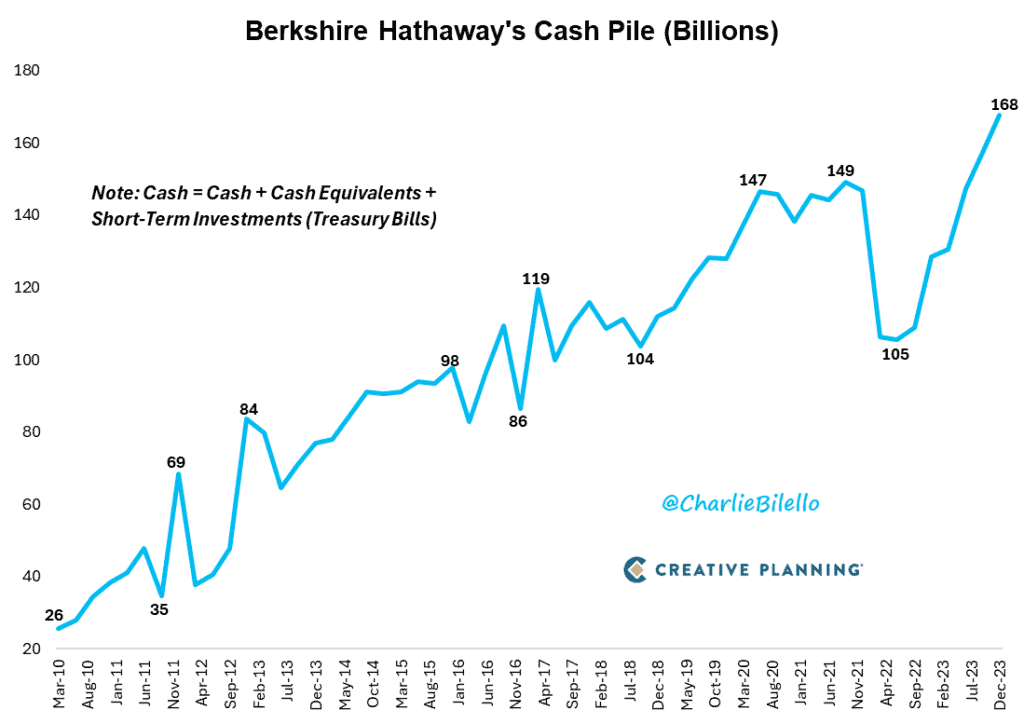

- Is Berkshire a net seller or net buyer of stocks (especially US stocks) thus far in 2024?

Aside from investments in itself (through buybacks), Berkshire invests in both private and public businesses. The private business deals tend to be more opportunistic, but Berkshire’s public stock purchases can be taken as a loose barometer for how Buffett feels about US stocks (or whatever market he transacts in; it’s mostly the US).

As Charlie Bilello’s graph below shows, Berkshire has been accumulating quite a bit of cash in the past year, after deploying a fair bit in the depths of the 2022 drawdown. Granted, as Berkshire grows, we’d expect its cash balance to grow in lockstep, but the below graph seems to indicate that Buffett found stocks to be cheap in 2022 (a down year for US stocks) and fairly pricey in 2023.

Source: Charlie Bilello

I’m looking forward to hearing more from Mr. Buffett on the attractiveness of both Berkshire Hathway’s stock and US stocks generally at the meeting.

Like last year, I’ll be at the meeting with BBAE analyst Shaoping Huang, so please stay tuned for our upcoming Berkshire videos and articles!

James

This article is for informational purposes only and is neither investment advice nor a solicitation to buy or sell securities. All investment involves inherent risks, including the total loss of principal, and past performance is not a guarantee of future results. Always conduct thorough research or consult with a financial expert before making any investment decisions. James owns shares of Berkshire Hathaway. BBAE has no position in any investment mentioned.