(Insert dramatic movie trailer voice)

In a year in which the Nasdaq has risen 45%…

In a year in which the S&P 500 has gone up 26%…

And in a year in which the Dow Jones Industrial Average is at a new high…

Most stocks have just done just OK, and many were barely above breakeven before the recent rally.

The equal-weight S&P 500 is now up a more modest 10%. The small cap-focused Russell 2000 is up 14%.

But the once-mighty iShares Biotechnology Index ETF (NYSE: IBB) is up a mere 0.33%.

Its equal-weight cousin, the SPDR S&P Biotech ETF (NYSE: XBI) in fact, is at roughly 50% of its peak value in February 2021. That doesn’t mean it belongs at that valuation, but it also seems reasonable to wonder if biotech is set for a 2024 rebound.

Spoiler: 2024 may be premature for a biotech rebound. In fact, I’m not here to foretell any specific future. (In 2022, JP Morgan surveyed institutional investors and found that 73% of them expected biotech to outperform the S&P 500 in 2023, which obviously didn’t happen.) But while biotech is going through a deserved shakeout – see below – a case can be made for opportunity once the dust settles.

Biotech: Why it’s down

- Interest rates: The main reason biotech is down has nothing to do with biotech. When discount rates are zero, there’s no difference between a dollar (or pound, or euro) in your pocket and one expected to come 10 years hence. When discount rates are high, there’s a huge difference. Biotech is a poster child for the “unprofitable now, but big money coming in a decade”-type stock – exactly the type of stock that got hammered as rates rose.

| Present Value of $1 by Year and Discount Rate | |||

| Year 0 | Year 10 | Year 15 | |

| 0% | $1.00 | $1.00 | $1.00 |

| 10% | $1.00 | $0.39 | $0.24 |

| 15% | $1.00 | $0.25 | $0.12 |

- Oversupply: Biotechs have been disappearing, but there were something like 3,000 biotechs in the US (more than 800 of them publicly traded) a year ago. Meanwhile, the US FDA approves only about 50 new treatments per year. Not every biotech is vying for an approval every year, but do the approximate math: if 3,000 people show up at a restaurant that seats 50, or even 300, most are going to be standing outside.

More than 200 biotechs are trading for less than the value of the cash they hold. Normally, this might indicate a cheap stock. With biotechs, it may just indicate a dying company.

Biotech: Simple bull case

I don’t like overly complicated investment theses. Biotechs individually sometimes have them, but biotech as an industry doesn’t.

- Biotech has tended to outperform the broader market. Not always, but poke around with a charting tool and you’ll see that biotech indices have spent a lot of time leading the S&P 500.

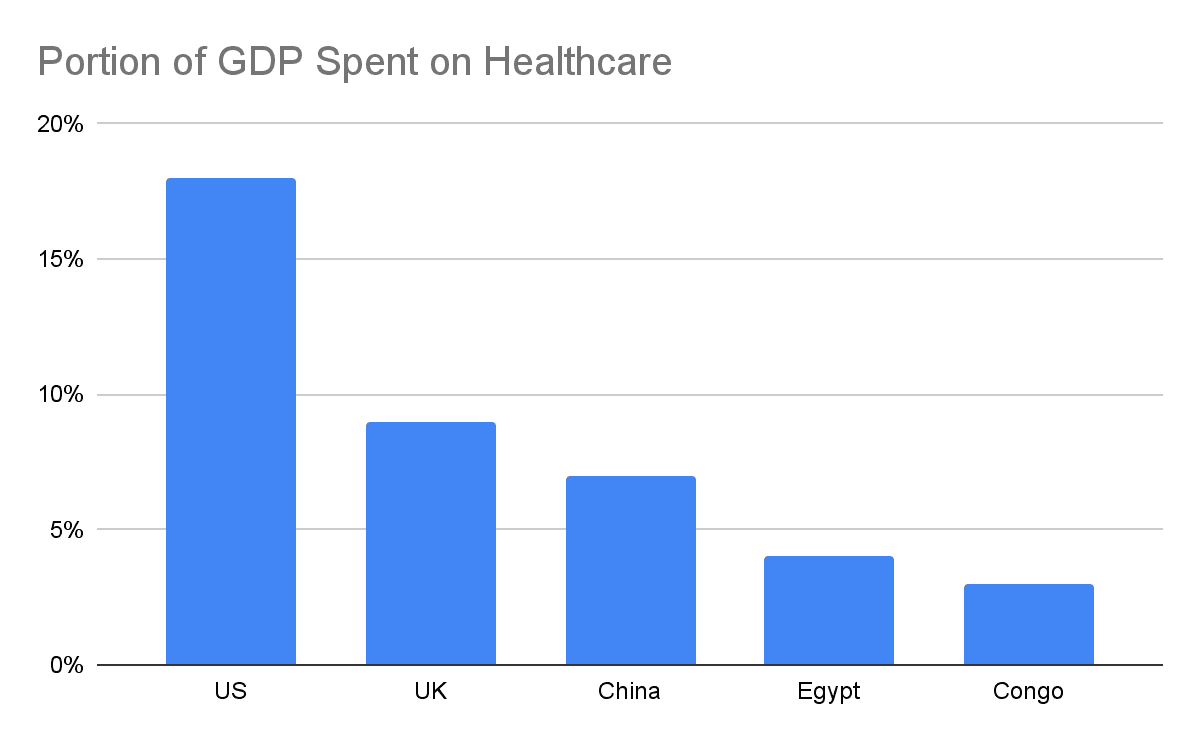

- The world is getting older and wealthier, and healthcare spending as a percentage of GDP is increasing. The wealthy US, breadbasket of biotech innovation, spends 17% of its GDP on healthcare. Other countries lag (far) behind, but better healthcare is like flush toilets and running water – once a country gets it, it’s not giving it up. China, for example, spent 3% of its GDP on healthcare in the 1980s – roughly where Congo is today – then 4% in the 1990s, and now spends 7%.

- Interest rates will likely come down in 2024. We can’t know by how much and when, but the US Federal Reserve itself currently predicts making at least three quarter-point rate cuts in 2024. (NB: If you’re new to Fed watching, you’ll know not to treat this as gospel.)

Biotech: More complicated bull case

We can add a few more details if we care to get technical:

- New drugs are actually getting cheaper to make. Believe it or not, though it still takes from $1 billion to a little over $2 billion to bring a typical drug to market, depending on whose estimate you’re using. The industry has turned an efficiency corner in the past decade or so, and AI and precision medicine should cheapen development further and improve the probability of success.

- Big Phamras have hundreds of billions in cash. Scope Research says that the 10 largest pharmaceutical companies have a collective $120 billion in dry powder. Stifel says the whole industry has $500 billion. Big Pharma – which traditionally buys biotechs as a source of innovation – is poised to be the shot in the arm investors in at least a few lucky companies need. One glitch: biotech M&A decreased in 2023 relative to 2022 (ironically, 87% of those JP Morgan pollees expected 2023 M&A volume to surpass 2022’s).

Which biotechs will do well once the “biotech winter” passes?

The first question is how long the washout will take. Industries need a good cleanse every so often; I won’t try to predict the timing. But I will say that attrition of the unfit biotechs (companies that wouldn’t have gotten off the ground in normal times, but only did so because of low interest rates and market exuberance) and the return to prosperity – improved stock price – of healthier biotechs can theoretically happen concurrently.

I don’t know when biotech ETFs will start to turn around. I also don’t know which individual biotechs are best to buy, but I do believe the latter is an easier prediction than the former.

Even with dropping interest rates, stock market investors are likely done – for now – with throwing money at exciting biotechs. That’s Big Pharma’s job now. And Big Pharma does it a lot less “blindly” than the market.

| Date Announced | Target | Acquirer | Size | Premium |

| 10/2022 | Akouous | Eli Lilly | $487 million | 78% |

| 10/2022 | Myovant | Sumitovant Biopharma | $1.7 billion | 10% |

| 10/2022 | Aveo Oncology | LG Chem | $566 million | 43% |

| 11/2022 | Oyster Point Pharmaceuticals | Viatris | $424 million | 32% |

| 12/2022 | Horizon Therapeutics | Amgen | $27.8 billion | 44% |

| 3/2023 | Seagen | Pfizer | $43 billion | 33% |

| 4/2023 | Prometheus Biosciences | Merck | $11 billion | 75% |

Betting on a buyout has always been a thing in biotech, but it’s likely an even bigger thing now.

As an example – not a recommendation – BioMarin (Nasdaq: BMRN), which makes treatments for rare diseases like hemophilia and dwarfism, has been considered one of the most likely takeover candidates by multiple analysts in the past few years, despite not being on FierceBiotech’s 2023 list of biotech takeover targets (this year, #1 is Ascendis Pharma (Nasdaq: ASND) and #2 is Ahira Pharma (Nasdaq: ATHA), if you’re curious, but FiercePharma is just one source of these predictions).

Besides finally turning a profit, the company gets just 10% of its revenue from Medicare, making it largely insulated from potential future Medicare drug price negotiations. It’s traditionally had one of the highest research and development budgets as a fraction of sales in the industry, but needs more distribution, and if its can bring some of its sky-high treatment costs down (its one-and-done hemophilia cure costs $3 million), it can likely tap into a lot more volume. Distribution and cost reduction are problems that Big Pharma can help with.

Don’t bet on this (and BioMarin is just an example; in fact, its stock is down 6% year-to-date). Don’t bet on any singular event – or at least that’s good advice for most investors. But it’s possible that the biotech winter will end with a buyout bonanza.

Disclaimer: This article is for informational purposes only and is neither investment advice nor a solicitation to buy or sell securities. Investing carries inherent risks. Always conduct thorough research or consult with a financial expert before making any investment decisions. Neither the author nor BBAE has a position in any investment mentioned.